File Your LUT Online for Hassle-Free Exports

India's Leading Letter of Undertaking Service With Trusted Compliance Professionals

Exporting goods or services without paying IGST? FinFlickTax helps you file your GST LUT (Letter of Undertaking) quickly and correctly. Our experts handle documentation, filing, and renewals—ensuring smooth compliance and uninterrupted exports.

Avoid delays, save tax, and stay compliant with our guided support.

Thousands of exporters trust FinFlickTax for fast and accurate LUT filing every year.

Overview on letter of Undertaking (lut)

At FinFlickTax, Whether you’re laying the foundation of a new venture or scaling toward greater heights, one thing remains constant — the need for timely and accurate TDS return filing. At FinFlickTax, we recognize that TDS compliance isn’t just a statutory requirement; it’s a reflection of your business’s financial discipline, transparency, and long-term credibility.

Filing TDS returns can often be complex, involving multiple deductees, varied payment types, and strict deadlines. But with our expert-backed approach, the process becomes smooth, efficient, and entirely worry-free. Our team of experienced professionals takes care of everything — from collecting and verifying data to checking for inconsistencies and ensuring accurate filings — so you don’t have to worry about penalties, interest, or regulatory scrutiny. Each return is carefully prepared, reviewed for errors, and submitted well within the deadlines set by the Income Tax Department, ensuring your business remains compliant and audit-ready at all times.

India is famous for its tea, petroleum resources, Muga silk, and biodiversity goods. All the items mentioned above are covered under the purview of GST. For example – 5% GST is charged on tea and coffee. That is why we believe it is important to understand GST thoroughly — especially if you’re planning to export goods or services without paying IGST, which requires filing a Letter of Undertaking (LUT).

While the LUT filing process under GST is paperless, many businesses still find it challenging to go through the procedure. That’s why it’s crucial to understand the eligibility, documentation, and renewal timeline involved.

Get your LUT filed accurately and on time with FinFlickTax, one of the leading GST consultants in India. We provide top-rated LUT filing services and offer end-to-end guidance on eligibility, filing procedures, and compliance so that you can focus on growing your exports — tax-free.

India is among the countries where export businesses enjoy zero-rated supply benefits under GST — provided they submit a valid LUT. Failing to do so means you may have to pay IGST and then claim a refund later, which adds to time and paperwork.

Who Needs Letter of Undertaking?

As per GST rules, any person or business engaged in the export of goods or services without payment of IGST is required to file a Letter of Undertaking (LUT) under the following circumstances:

Exceeding the Threshold Limit

If your total tax liability for the financial year exceeds ₹10,000, you are required to pay advance tax in installments during the year itself.

Voluntary Registration

Even if you’re not legally required, individuals and businesses may opt for voluntary tax payment to avoid interest under Sections 234B & 234C.

Compulsory Registration

Freelancers and self-employed individuals Companies and LLPs Individuals with capital gains, rent, or interest income.

Eligibility For Letter of undertaking in India

✅ Exporters of goods or services without payment of IGST can file LUT to avoid tax upfront.

✅ LUT is valid for one financial year and needs to be renewed annually.

✅ Filing LUT online avoids the need for bonds and bank guarantees.

✅ Businesses registered under GST and not prosecuted for tax evasion above ₹250 lakh can file LUT.

✅ LUT must be furnished before making exports to ensure GST compliance.

✅ Delayed or missed LUT filing can lead to liability of paying IGST on exports.

✅ FinFlickTax assists with error-free LUT filing and renewal across India.

NEED HELP

✅ FinFlickTax helps you determine if you’re eligible to file a Letter of Undertaking (LUT) for exporting goods or services without payment of IGST.

✅ We assist in preparing the required documents such as GST registration certificate, PAN, KYC of authorized signatory, and previous LUT (if applicable).

✅ Our experts ensure that your LUT application is filed accurately and submitted through the GST portal on time.

✅ We track the status of your LUT approval and provide you with the acknowledgment once approved by the department.

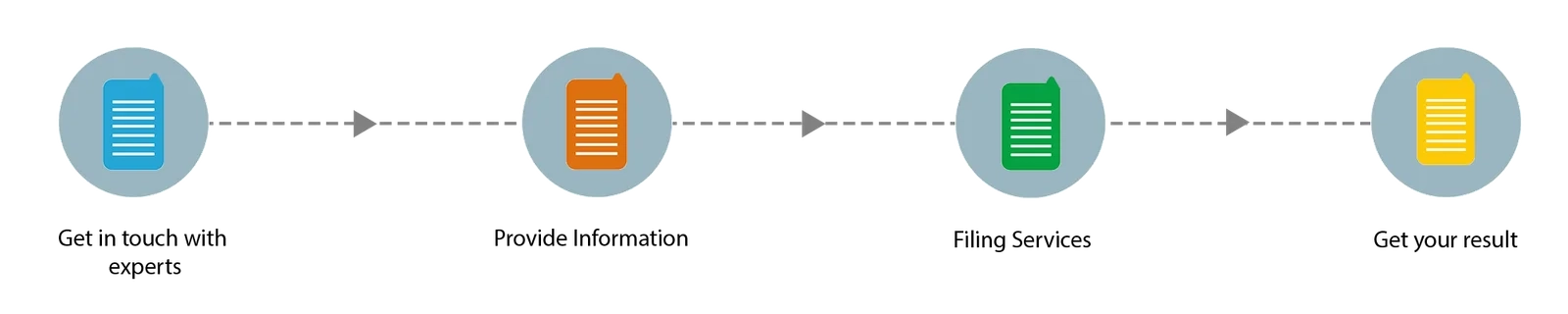

Process Of Letter of Undertaking (LUT)

1. Connect with Our GST Experts

Book a free consultation with FinFlickTax to check whether you’re eligible to file an LUT under GST. Our experts will explain the benefits, especially if you’re an exporter or service provider dealing in zero-rated supplies.

2. Gather Required Business Information

To proceed with your LUT filing, you will need to submit the following documents and details:

GSTIN of the business

Name of authorized signatory

PAN card of the entity

Copy of IEC Certificate (if applicable)

Previous LUT or Bond (if filed before)

Digital Signature Certificate (DSC), if required

Nature of goods/services exported

Providing complete and accurate information ensures a quick and error-free application.

3. Login to GST Portal & Navigate to LUT Section

FinFlickTax will help you:

Log into the official GST Portal

Go to Services > User Services > Furnish LUT

Select the financial year for which you’re filing the LUT

Fill in required details and attach supporting documents (if needed)

4. Submit & Sign the LUT Form

After entering the information, the form is submitted using either:

Digital Signature Certificate (DSC) or

Electronic Verification Code (EVC) sent to the registered mobile/email

We ensure that your LUT is signed and filed correctly to avoid future compliance issues.

5. Download the Acknowledged LUT

Once submitted successfully, you will receive an Acknowledgement Reference Number (ARN).

You can use it to download the approved LUT from the GST portal for your records. This LUT is valid for one financial year.

Frequently Asked Questions

What is a Letter of Undertaking (LUT) under GST?

A Letter of Undertaking (LUT) is a document that allows exporters to make exports without paying Integrated GST (IGST). It is filed online through the GST portal and is valid for one financial year.

Who is eligible to file an LUT under GST?

Any GST-registered person who intends to supply goods or services for export without payment of IGST is eligible, provided they haven’t been prosecuted for tax evasion exceeding ₹2.5 crore in the last five years.

What are the benefits of filing an LUT?

Filing an LUT saves working capital by allowing exporters to export without paying IGST upfront. It also eliminates the need for a bond or bank guarantee, making the process faster and more cost-effective.

What documents are required to file an LUT?

The primary documents include:

GST registration certificate

PAN of the business

Authorized signatory details

IEC code (if applicable)

Previous LUT (if any)

How long is the LUT valid, and when should it be renewed?

An LUT is valid for one financial year. It should be renewed at the beginning of each new financial year to continue exporting without paying IGST.

Trusted by Exporters for Hassle-Free LUT Filing Services Under GST

Ravi Choudhary

Quick and smooth LUT filing experience

Jaipur, Rajasthan

“I needed to file a Letter of Undertaking urgently for exports, and Finflick made the process fast and stress-free. Their team handled the entire filing without delays. Very efficient!”

Farheen Khan

Great support for export businesses

Surat, Gujarat

“Being new to exports, I didn’t know how to apply for LUT under GST. Finflick not only filed it correctly but also explained the benefits clearly. Totally satisfied with their service.”

Rajan Shukla

Professional and timely LUT filing service

Kochi, Kerala

“Finflick takes care of our LUT filing every year. They’re punctual, precise, and their expert handling saves us from unnecessary GST payments. Excellent team for compliance work!”