Close Your GST Registration Easily & Legally

India's Leading GST Cancellation Service With Trusted Compliance Professionals

No longer running your business or shifting to a different structure? FinFlickTax helps you cancel your GST registration quickly, with complete documentation, final return filing, and compliance checks.

Avoid future penalties and keep your records clean with expert-managed GST cancellation services.

Thousands of business owners rely on FinFlickTax for smooth and error-free GST cancellation.

Overview on GST Cancellation

At FinFlickTax, We Believe in Being Prepared — Even When It’s Time to Exit Whether you’re winding down your business, restructuring, or no longer meeting the GST threshold, cancelling your GST registration on time is just as important as registering. With FinFlickTax, the process is smooth, guided by experts who understand the need for accuracy, compliance, and peace of mind.GST isn’t just a tax system — it’s a legal identity for your business. But when that identity is no longer needed, keeping it active can create unnecessary compliance burdens. That’s why thousands of businesses across India trust FinFlickTax to help them exit the GST regime legally and hassle-free. Every stage of a business journey requires attention to compliance — including when it’s time to step back. Whether you’re closing down operations, undergoing a merger or acquisition, shifting to a different business model, or simply falling below the GST threshold, cancelling your GST registration isn’t just a formality — it’s a critical step in protecting your business from future liabilities. At FinFlickTax, we help you navigate this process with clarity and confidence.

India has a diverse economy with sectors like tea, petroleum, textiles, and handicrafts falling under the GST regime. While GST registration is mandatory for many businesses, it’s equally important to know when cancellation is appropriate.Though the GST registration process is fully online, cancellation can be complex due to eligibility checks, compliance status, and document requirements. That’s why it’s essential to understand the cancellation criteria before proceeding.

If your business has stopped operations, your turnover is below the GST threshold (₹20 lakhs or ₹10 lakhs for special category states like Assam, Manipur, etc.), or if you registered voluntarily but no longer need GST, cancellation may be the right step.As one of India’s leading GST consultants, FinFlickTax offers end-to-end support for GST cancellation — including eligibility checks, documentation, application filing, and post-cancellation compliance.

Let us help you legally exit the GST system while staying 100% compliant.

Who Needs GST Cancellation?

As per the GST Act, a person or business is required to obtain GST cancellation under the following circumstances:

Exceeding the Threshold Limit

If your annual turnover is under the ₹20 lakhs (₹10 lakhs Only for special category states ), you may not need GST registration.

Voluntary Registration

If your turnover is below the threshold and GST compliance is no longer needed, you can cancel your registration to reduce filing.

Compulsory Registration

Certain taxpayers like e-commerce sellers, agents, and RCM-liable persons must register under GST regardless of turnover.

At Finflicktax, we make the GST registration process hassle-free, fast, and completely online. Our experts handle the paperwork, compliance, and documentation — so you can focus on growing your business while we take care of the taxes.

Who Qualifies as a "Person" Under GST?

Under GST law, the term “person” is broadly defined and includes various entities such as individuals, sole proprietors, partnership firms, LLPs, private or public companies, AOPs/BOIs, Hindu Undivided Families (HUFs), trusts, co-operative societies, foreign companies, government bodies, local authorities, and other artificial juridical persons.

If your business falls under any of these categories and is no longer liable to be registered under GST, you may be eligible for GST cancellation.

Not sure if you can cancel your GST registration?

Connect with the experts at FinFlickTax — we’ll review your business type and help you cancel your registration legally and smoothly in full compliance with GST law.

NEED HELP

Don’t worry if the process feels overwhelming. FinFlickTax will help you:

Identify the exact documents required for your type of business and reason for cancellation

Prepare and organize all information in the correct format for submission

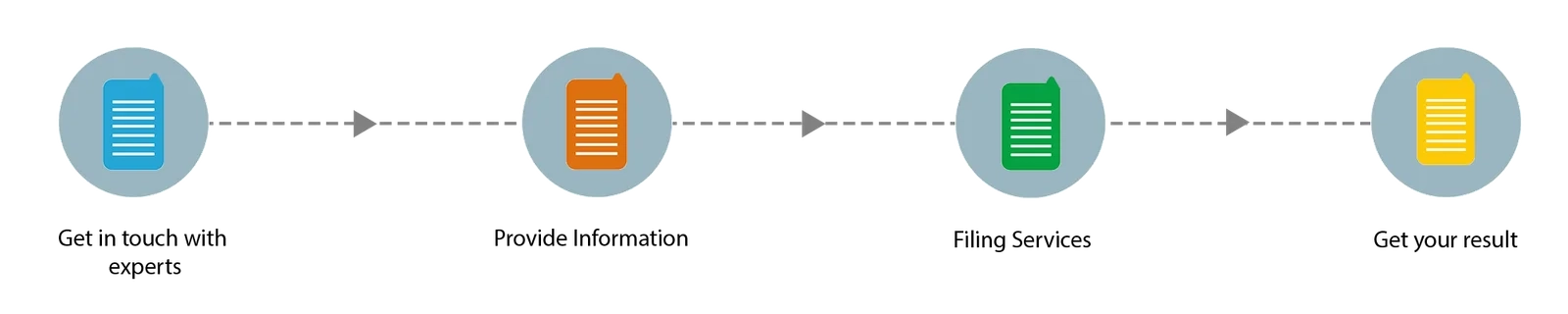

Process Of GST Registration

Step-by-Step Procedure for GST Cancellation — by FinFlickTax

The process of GST cancellation is straightforward, but it requires careful documentation and timely action. At FinFlickTax, we assist businesses, professionals, and individuals through every step — from evaluating eligibility to final submission — ensuring a hassle-free and compliant exit from the GST system.

Here’s a brief overview of the complete procedure to cancel your GST registration:

1. Connect with Our GST Experts

Book a consultation with FinFlickTax specialists to understand whether GST cancellation is right for your business and get expert assistance on the process.

2. Submit Your Business & Cancellation Details

To begin the cancellation process, you’ll need to provide key business details and reasons for cancellation, such as:

GSTIN to be cancelled, Reason for cancellation (e.g., business closed, turnover below threshold), Effective date of cancellation, Details of stock (if any), Supporting documents (if applicable), Providing complete and accurate details helps prevent delays or rejection.

3. Filing the Cancellation Application

FinFlickTax will help you file Form GST REG-16 on the GST portal with all required information. Our experts ensure the application is submitted correctly and on time.

4. Receive Cancellation Order

Once the tax officer reviews and approves your request, a GST cancellation order will be issued. You’ll be notified via email/SMS, and the cancellation certificate can be downloaded from the GST portal for your records.

How to Download GST Cancellation Order

Follow these simple steps to download your GST cancellation order from the GST portal:

Once your GST cancellation application is approved:

Visit the official GST portal: gst.gov.in

Log in using your GST username and password

Navigate to Services → User Services → View/Download Certificates

Click on Download next to the cancellation certificate — the PDF will be saved to your device

Frequently Asked Questions

What is GST cancellation?

GST cancellation means the permanent closure of a GST registration. Once cancelled, the taxpayer is no longer required to collect or pay GST, nor file GST returns.

Who can apply for GST cancellation?

GST cancellation can be initiated by:

The taxpayer (voluntary cancellation)

A GST officer (suo moto)

Legal heirs (in case of death of proprietor)

What are common reasons for cancelling GST registration?

Business discontinued or transferred

Change in business constitution (e.g., proprietorship to partnership)

Taxpayer no longer liable for GST (turnover below threshold)

Mistaken multiple registrations

How can I cancel my GST registration?

You can apply for cancellation online through the GST Portal:

Log in to gst.gov.in

Navigate to Services → Registration → Application for Cancellation

Fill Form GST REG-16 with reason and required details

Submit with digital signature or EVC

Is it mandatory to file final returns after cancellation?

Yes, you must file Final Return (GSTR-10) within 3 months from the date of cancellation or cancellation order, whichever is later.

Can I reactivate a cancelled GST registration?

No. Once cancelled, the same GSTIN cannot be reactivated. However, you can apply for new registration if needed.

What if GST is cancelled by the department?

If your GST is cancelled by a GST officer, you can file for revocation of cancellation within 30 days from the date of the cancellation order using Form GST REG-21.

Making GST Cancellation Easy – What Our Clients Say

Ramesh Sahu

Smooth & Hassle-Free GST Cancellation

Raipur, Chhattisgarh

“I closed my business recently and had no idea how to cancel my GST registration. Finflick Tax handled everything from paperwork to portal updates. The process was fast and transparent. Highly professional service!”

Rajan Shukla

Quick GST Closure with Full Support

Malad West, Mumbai

“After shutting down my boutique, I wanted to cancel my GST without complications. The team guided me patiently, filed the return, and completed the cancellation smoothly. I’m very satisfied!”

Deepika Mehta

Trustworthy GST Exit Service

Gomti Nagar, Lucknow

“I was worried about notices or penalties, but Finflick Tax ensured everything was compliant and error-free. They even followed up after the cancellation. Excellent service from start to finish!”