You can log into the GST Portal, go to Services > Ledgers > Electronic Credit Ledger, and download your ITC statement for review.

Trusted CC Limit Experts in India

Boost Your Working Capital with a CC Limit

India Leading CC Limit Service With Trusted Compliance Professionals

Need funds to manage inventory, receivables, or day-to-day operations? FinFlickTax helps businesses secure Cash Credit Limits from leading banks—backed by strong financials and expert advisory.

We assist with eligibility checks, paperwork, and lender coordination to ensure fast approvals and optimized limits.

Trusted by 15,000+ businesses for securing CC Limits to fuel consistent growth.

Overview on GST CC Limits In India

Understanding the GST Cash Credit (CC) Limit is crucial for every registered taxpayer aiming to stay compliant and optimize Input Tax Credit (ITC). The Cash Credit Limit essentially refers to the maximum portion of ITC that a business can utilize from its electronic credit ledger to offset its GST liability. However, recent GST regulations introduced by the Government of India have brought tighter control over how this credit can be availed — particularly in situations involving discrepancies in vendor reporting.

As per the latest guidelines, if an invoice issued by a supplier is not reflected in the recipient’s GSTR-2B, the buyer can only claim up to 5% of the eligible ITC on such invoices beyond the auto-populated amount. This means that unless your supplier has filed their returns correctly and included the transaction, your ability to claim ITC is significantly restricted.

The GST Cash Credit Limit refers to the portion of Input Tax Credit (ITC) that a registered taxpayer can utilize online through the electronic credit ledger on the GST portal to pay off GST liabilities. As per the latest rules:

You can only use ITC that appears in GSTR-2B (auto-generated from supplier uploads).

If invoices are not reflected in GSTR-2B, you are allowed to claim only 5% of such unmatched credit.

Credit cannot be used for late fees, interest, or penalties — those must be paid in cash.

Under Rule 86A, authorities can block or restrict credit if they suspect misuse, fraud, or mismatches.

This credit is applied digitally during GST return filing, and taxpayers must ensure that their vendors are also compliant. Managing online ITC accurately ensures smooth compliance and avoids cash blockages during monthly or quarterly return filings.

At Finflicktax, we help businesses monitor their online cash credit ledger, ensure vendor compliance, and stay within ITC usage limits — so your GST filings are smooth, accurate, and hassle-free.

Who Needs CC Limit ?

he GST Cash Credit (CC) Limit becomes relevant for any registered business or taxpayer that regularly claims Input Tax Credit (ITC) while filing GST returns. This includes:

Businesses with high purchase volumes

Companies that buy raw materials, stock, or services frequently need to use ITC to reduce their tax liability — and must regularly track how much credit is usable .

Traders, Wholesalers & Manufacturers

Since they deal with large supplier networks, mismatched invoices or delayed GSTR-1 filings by vendors can restrict available credit, making CC limits essential to manage.

Service Providers (like IT, logistics, marketing firms)

"If you rely on business expenses like software, ads, consulting services, subscription tools, the credit limit directly affects how much offset in your GST return."

Eligibility For CC Limit In India

✅ Must be a GST-registered taxpayer with an active GSTIN.

✅ Invoices must be reflected in GSTR-2B to claim credit.

✅ Regular and timely filing of GSTR-1 and GSTR-3B is required.

✅ Credit can only be claimed for goods/services used for business purposes.

✅ No fraudulent or suspicious ITC activity under Rule 86A.

✅ Vendor compliance is essential — non-filing suppliers can limit your credit.

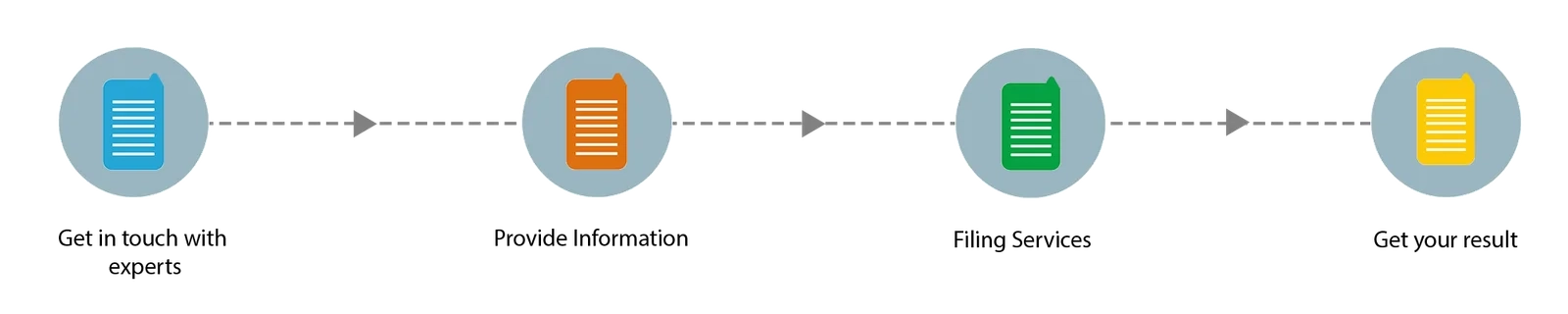

Process Of Income tax Service

Process of Income Tax Service in India — by Finflicktax

Filing income tax returns and ensuring compliance with the Income Tax Act can be complex—especially when dealing with multiple income sources, deductions, or business transactions. At Finflicktax, we simplify the entire process and guide you through each step, ensuring your returns are filed accurately, on time, and with maximum possible tax savings.

Here’s a step-by-step overview of how we handle your Income Tax Service:

NEED HELP

Confused about how much Input Tax Credit (ITC) you can claim?

Is your GSTR-2B not matching with invoices from your vendors?

Worried about ITC being blocked under Rule 86A?

Need expert help reconciling your credit and avoiding penalties?

Process Of CC Limit In India

How to Download CC Limit Certificate

✅ Step 1: Visit the GST Portal

✅ Step 2: Navigate to ‘Ledgers’

✅ Step 3: Choose the Date Range

✅ Step 4: View & Download

✅ Step 5: Use for Record or Compliance

Frequently Asked Questions on CC Limit (FAQ)

What is the GST CC (Cash Credit) Limit?

The CC Limit refers to the maximum Input Tax Credit (ITC) a taxpayer can use from their electronic credit ledger to pay GST liability. It depends on factors like GSTR-2B match, filing history, and vendor compliance.

Can I claim full ITC if my invoice is not in GSTR-2B?

No. If the invoice is not reflected in GSTR-2B, you can claim only up to 5% of eligible ITC under Rule 36(4). Full ITC is allowed only for matched invoices.

Who can use the GST cash credit?

Only GST-registered taxpayers who file GSTR-1 and GSTR-3B on time, and whose vendors are also compliant, can use the cash credit to offset their tax liabilities.

Can my ITC be blocked by the GST department?

Yes. Under Rule 86A, if authorities suspect fraud or invoice mismatch, they can temporarily block or restrict access to your Input Tax Credit.

Where can I check my CC limit or ITC balance?

What Our Client Says About Our CC Limit Service

Ramesh Kumar

Best online CC Limit Services

Chennai, Tamil Nadu

“I needed urgent working capital support and didn’t know how to proceed with a CC limit. Finflick Tax handled everything professionally and quickly.”

Shweta Patel

Impresses for CC Limit Service

Ahmedabad, Gujarat

“Thanks to Finflick, I was able to get my CC limit approved in record time. They guided me at every step and ensured I got the best deal from the bank.”

Neeraj Joshi

Stress Free Online CC Limit Service

Indore, Madhya Pradesh

“Finflick’s CC limit services helped my manufacturing business in scaling operations. Very responsive and experienced team. Highly recommended!”