Absolutely! We assist our clients in tracking, downloading, and understanding all important loan documents — including the certificate — from any lender.

Trusted Busisness Loan Experts in India

Get the Right Business Loan with Expert Support

India Leading Buisness Service With Trusted Compliance Professionals

Need funds to scale, manage cash flow, or invest in infrastructure? FinFlickTax connects you with top banks and NBFCs offering tailored business loan solutions. Our experts help you choose the right product, prepare error-free documentation, and ensure fast loan approvals with minimal hassle.

Your growth is our priority—get funded with confidence.

25,000+ entrepreneurs secured business loans with FinFlickTax’s expert support.

Overview on Busisness Loan In India

At FinFlickTax, We Believe in Being Prepared At FinFlickTax, we assist businesses in identifying the right loan product, preparing documents, comparing offers, and applying with the most suitable lenders. Whether you need funds for inventory, staffing, marketing, or growth, we simplify the process so you can focus on building your business — not chasing paperwork.A business loan in India is a financing solution offered by banks, NBFCs, and fintech lenders to help entrepreneurs meet their working capital needs, manage cash flow, expand operations, or purchase equipment. These loans are typically unsecured (no collateral required) and are offered based on the borrower’s credit score, business turnover, and financial documents.These loans can be used for a variety of purposes.

In today’s fast-paced economic environment, businesses — whether small, medium, or growing startups — often require external funding to sustain operations, scale up, or grab growth opportunities. A Business Loan is one of the most accessible and flexible financing options available in India for entrepreneurs seeking timely capital without diluting ownership.

Business loans are offered by banks, NBFCs, and digital lending platforms and are available as both secured and unsecured loans. Unsecured loans are based on your creditworthiness and cash flow, while secured loans require collateral like property, inventory, or fixed deposits. The loan amount typically ranges from ₹50,000 to ₹5 crores, depending on the business profile, revenue, and credit score.

These loans can be used for a variety of purposes — such as working capital, inventory purchase, office expansion, staff salaries, equipment purchase, or even for marketing and digital growth. Most lenders offer repayment tenures between 12 months to 5 years, with interest rates starting around 10% to 18% per annum, based on the risk assessment.

The Indian government also promotes business financing through subsidized MSME loan schemes like MUDRA, CGTMSE, and Stand-Up India, making funding more accessible for startups, women entrepreneurs, and small enterprises.

At FinflickTax, we understand that getting the right loan isn’t just about money — it’s about timing, trust, and tailored solutions. We offer:

✅ End-to-end support for document preparation

✅ Lender comparison based on your unique needs

✅ Application assistance for both private and government-backed loans

✅ Post-loan advisory on repayment and compliance

With our expert guidance and vast lender network, FinflickTax ensures your business gets the capital it needs — quickly, transparently, and with minimal stress.

Who Needs Buisness Loan In India?

A business loan is ideal for anyone looking to start, run, or grow a business in India. Whether you’re a first-time entrepreneur or an established business owner, business loans offer flexible funding options without sacrificing ownership.

E-commerce Sellers

investing in stock, warehouse space, or delivery systems

MSMEs

(Micro, Small & Medium Enterprises) looking for working capital.

Retailers and Traders

who need to maintain inventory or meet seasonal demand

Eligibility For Buisness Loan In India

✅ Businesses with annual turnover above ₹20 lakhs needing funds for expansion or operations

✅ New and growing startups seeking working capital or investment in infrastructure

✅ Retailers, wholesalers, and distributors managing stock and vendor payments

✅ Professionals and consultants like doctors, lawyers, and freelancers looking to scale their services

✅ Manufacturers and production units upgrading machinery or increasing capacity

✅ Input Service Providers (ISPs) and B2B service firms managing project-based expenses

✅ E-commerce sellers and online businesses investing in inventory, logistics, or tech upgrades

✅ Franchise owners or small business operators expanding to new locations or adding services

NEED HELP

Don’t worry if the process feels overwhelming. FinflickTax will help you:

Verify which documents are needed based on your business type and loan requirements

Prepare and organize everything in the correct format for faster approval

Apply for the most suitable Business Loan with zero hassle and complete support

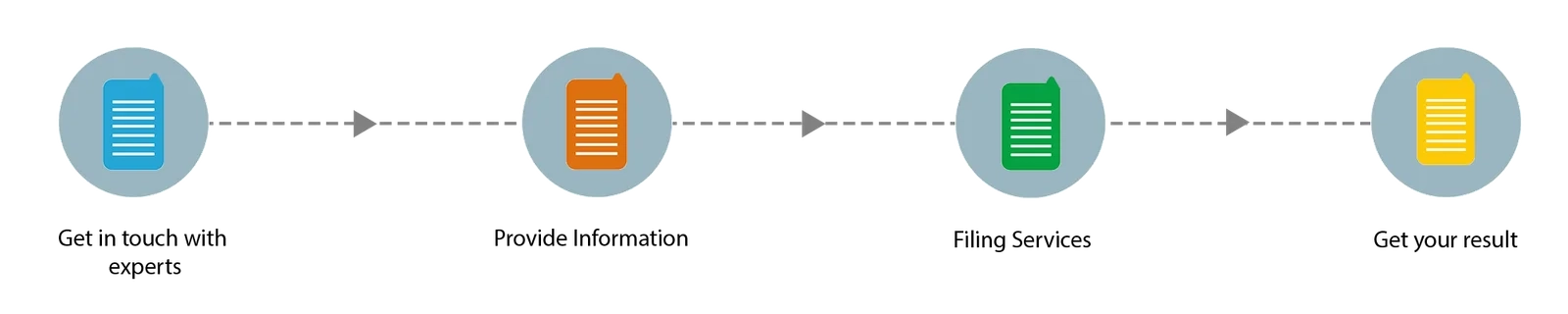

Process Of Business Loan in India

Step-by-Step Process of Business Loan in India — by FinflickTax

Applying for a business loan can be smooth and efficient when guided correctly. At FinflickTax, we help streamline the entire process for startups, SMEs, and professionals.

How to Download Business Loan Certificate

- Log in to Your Lender’s Portal

Visit your bank or NBFC’s official website or mobile app and log in using your credentials. Go to ‘Loan Accounts’ or ‘My Loans’ Section

Navigate to the section where all your loan details are listed.Select the Relevant Business Loan

Click on the specific loan for which you want the certificate or sanction letter.Download the Certificate/Sanction Letter

Look for options like “Download Sanction Letter”, “Loan Certificate”, or “Loan Summary”. Download the PDF and save it for your records.Alternative Option – Visit or Contact Your Branch

If the certificate isn’t available online, visit your nearest bank branch or contact your relationship manager to request a copy.

Frequently Asked Questions on GST Registration (FAQ)

What is a Business Loan Certificate or Sanction Letter?

It is an official document issued by the lender after your business loan is approved. It outlines key details such as the loan amount, interest rate, tenure, EMI, and repayment schedule.

Where can I download my Business Loan Certificate?

You can usually download it from your bank’s or NBFC’s online portal or mobile app under the “Loan Details” or “Sanction Letter” section.

Is the loan certificate required for financial audits or tax filings?

Yes. The loan certificate serves as proof of funds and is often needed during audits, tax assessments, or while applying for further credit.

What if my certificate isn’t available online?

No worries — you can visit your bank branch or contact your relationship manager to request a physical or digital copy.

Can FinflickTax help me retrieve my Business Loan Certificate?

Business Owners Rely on Us for Quick and Hassle-Free Business Loans

Vikram Singh

Stress Free Business Loans Services Provided

Jaipur, Rajasthan

“Finflick Tax made my business loan process super smooth. From documentation to disbursal, everything was handled professionally and quickly. Got my loan approved in just a few days!”

Neha Agarwal

Best Online Business Loan Service

Indore, Madhya Pradesh

“I was hesitant about applying for a business loan due to paperwork hassles, but Finflick made it easy. They guided me at every step and helped me secure the funds I needed.”

Saurabh Patel

Impresses for Business Loans Service

Surat, Gujarat

“Getting a business loan seemed impossible with my tight schedule. Thanks to Finflick, I got the right loan at the right time with zero stress.”